You may have money lying around and not even realise it... Learn how to check your CPF without leaving home and request a refund

Adverts

With the ease of opening and closing bank accounts, it's very common to forget amounts of money, whether it's in a savings account that you don't access very often, or in an investment portfolio that you started but didn't continue.

LAST DAYS!

CLAIM YOUR FORGOTTEN MONEY! DON'T MISS THE DEADLINE!

SEE HOW TO CASH OUT ❯❯ You will remain on the same site

Data from the central bank indicates that there are around 7 billion reais sitting idle and forgotten in some financial institution, and part of this amount could even be yours. The central bank points out that there are amounts from R$10 to more exponential amounts that exceed R$1,000.

And although it may seem like a complicated task, you should know that recovering forgotten money has gained prominence in recent years, especially with the increase in government initiatives to facilitate this process.

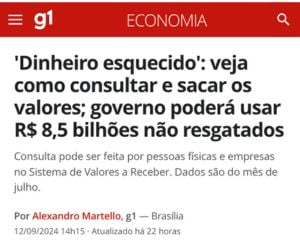

In 2021, the Central Bank launched the Receivables System (SVR)This initiative allows citizens to consult and claim forgotten amounts online and free of charge. This initiative has made it easier and more transparent for Brazilians to access their financial rights.

Find out now how you can consult and claim your forgotten money. Read on to find out more.

Quick Index:

Forgotten Money: what is it?

Forgotten money refers to all the money sitting idle in inactive bank accounts, or in life insurance policies, loyalty programmes and so on.

It might make sense to you:

- Receivables: more than R$ 7 billion forgotten

- All about the Will Bank Card

- First investments: how to get started in the financial market

These valuables are called "forgotten money" precisely because most of the time their owners are unaware of their existence or simply don't remember having them.

Identifying and claiming this money can be done through tools provided by financial institutions and the government.

The sources of forgotten money

As mentioned in the previous topic, forgotten money can be tied up in various sources:

Inactive accounts: if you've ever had a bank account and didn't use it for a long time, it's possible that the money in it may have been transferred to the state as forgotten or unclaimed money.

Unclaimed prizes: if you're someone who plays the lottery and forgets to check afterwards, you should know that many unclaimed prizes also go into the unclaimed money box.

Shares not redeemed: If you're not a very active investor, you should know that if you invest in a company that has been acquired or merged for some reason, you may be entitled to some of the proceeds from that deal. And the amounts can also go into the forgotten money fund.

Uncashed cheques: Even though they are rarely used these days, it is common for many people who receive cheques not to deposit them and end up losing access to the funds.

Benefits not redeemed: some people are entitled to government and state benefits, and because they don't move their account, their balance may also fall under the forgotten money category. It's worth checking!

How to consult

The best way to find out if you have forgotten money is through the Valores a Receber programme, created to simplify and facilitate the whole process free of charge.

The system consolidates the market's public and private institutions in its data system, making it easier to access information and recover money. With Valores a receber you can also search for a loved one, even if they have already died.

The most practical and reliable way

To check on the official system provided by the government and the central bank, simply go to the official Valores a Receber website and fill in the information requested. Remember that it must be the official government website to avoid falling victim to scams.

The most labour-intensive and cautious way

Another way to search for your forgotten money is to check each institution individually, but this requires a lot more effort. For this you will need

- Check each bank you already have an account with individually.

- Contact lottery companies to check on unclaimed prizes.

- Consult share transfer companies and check if your portfolio contains shares that have been acquired or merged.

How to claim

The process of recovering and claiming your forgotten money is simple once you have identified the amount and the source where it is being held. Although each source has its own process for recovery, generally you will need to:

- Fill in the required forms;

- Present an official photo ID (you may be asked for other documents such as proof of residence or something similar...)

- Wait for analysis and processing.

What happens if I don't redeem the money?

If your fear is that you'll lose the right to your money, you don't have to. But be aware that leaving money idle results in devaluation due to inflation. Even if the nominal value of forgotten money doesn't decrease, it can lose a large part of its purchasing power over time.

This is because inflation erodes the real value of money, reducing its ability to purchase goods and services. It is therefore essential to rescue your forgotten money and look for forms of investment that protect and potentially increase the value of your money, ensuring that it maintains or even increases its purchasing power in the future.

Tips for not forgetting money

Regular Reviews: Periodically review your bank accounts and loyalty programmes.

Document Maintenance: Keep financial documents and insurance policies properly organised.

Financial Education: Invest in financial education so that you are always aware of your rights and responsibilities.

Read also: PIS PASEP More than R$24 billion forgotten

Conclusion

Recovering forgotten money may seem like a challenge, but with the right tools and information, it's a process accessible to everyone.

Use the resources available to you, stay informed and don't let your money sit idle. Secure your financial rights and enjoy the benefits that these amounts can bring to your life.