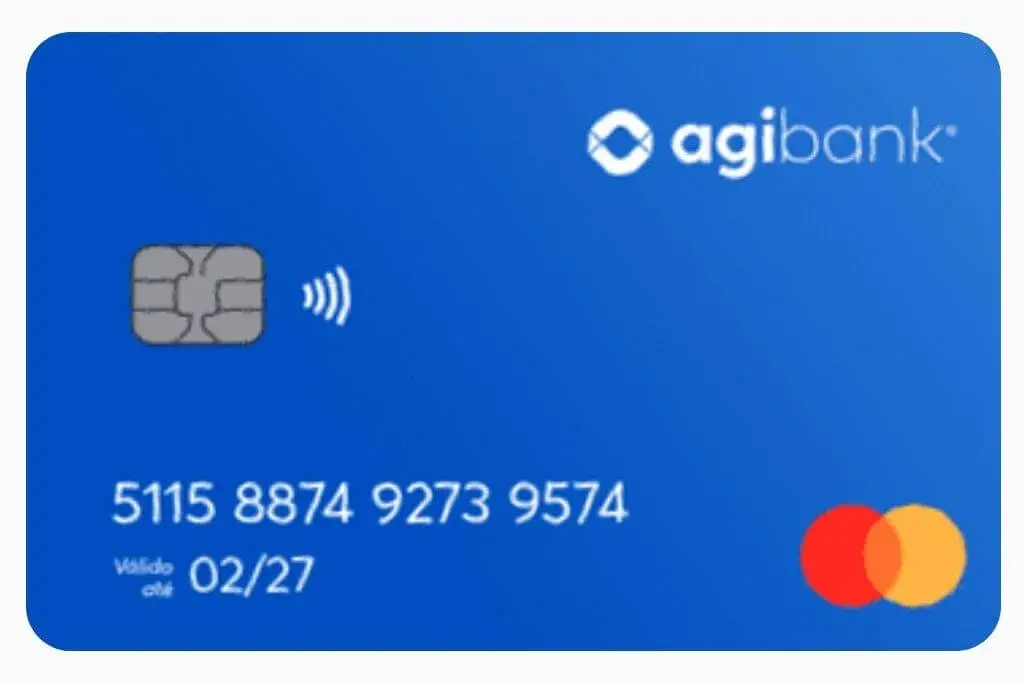

Are you looking for a card that combines technology and accessibility? The Agibank Card could be the ideal option for you. Find out all its features, advantages and how to apply for it here.

Adverts

The Agibank Card has been gaining prominence in the Brazilian financial market, especially among those looking for a practical and modern alternative for managing their finances.

Agibank is known for offering innovative solutions in the financial sector, with a focus on technology, accessibility and differentiated service, and its credit card follows the same pattern.

With a number of interesting features and options that vary according to the customer's profile, the Agibank Card aims to make financial control simpler, more efficient and more accessible, even for those who want their first credit card or are looking for a more flexible alternative.

Agibank's proposal is to offer practical benefits and resources for both domestic and international purchases, without sacrificing good service and special conditions.

In this article, we'll explore in detail what the Agibank Card offers, how it works, its main advantages and disadvantages, as well as tips for applying for the card. Read on to find out more.

Quick Index:

What is the Agibank Card?

The Agibank Card is a credit card offered by the Agibank digital bank, a Brazilian fintech company that has the distinction of operating in the financial market with a focus on technology and accessibility.

It is designed to cater for different customer profiles, including those who are looking for a card without a lot of bureaucracy, with an adjustable limit and the possibility of annual fee exemption.

In addition, the Agibank Card allows you to make purchases in physical and online shops, both in Brazil and abroad, thanks to its Mastercard flag, which is widely accepted throughout the world.

How the Agibank Card works

The Agibank Card is very simple and practical to use. It is available in both credit and debit modes, making it a versatile alternative for meeting various financial demands.

Customers can control all their spending, invoices and limits directly through the Agibank app, available for Android and iOS, guaranteeing complete monitoring of their finances.

The application process for the Agibank Card is all digital and, once approved, the customer receives the physical card at home.

From then on, they can make purchases, pay bills and enjoy the benefits of the Mastercard brand.

In the case of credit cards, the customer has the option of paying the bill in up to 12 instalments, which can be useful for organising the budget at specific times.

Below, we detail the main features of the Agibank Card for a complete overview of its attributes.

General Features

| Features | Description |

|---|---|

| Card Name | Agibank Card |

| Flag | Mastercard |

| Issuing Bank | Agibank |

| Annuity | Free in the first year; differentiated charges in subsequent years depending on profile |

| Cover | International |

| Existing models | Credit card and multiple card (credit and debit) |

| Limit | Defined according to credit analysis |

| Points Programme | Mastercard Surpreenda |

| Cashback programme | No direct cashback, but participates in partner discounts |

| Payment instalments | Up to 12 instalments for invoice payments |

| Official Website | https://agibank.com.br/cartoes |

| Name of the Management App | Agibank (available for Android and iOS) |

Advantages

First Year Tuition Fee Waiver: The Agibank Card offers no annual fee for the first year of use, an excellent advantage for those who are trying out the service. From the second year onwards, there may be an annual fee, but there are also possibilities for exemption depending on the client's profile and use of the card

International Coverage: With international coverage, the Agibank Card can be used for purchases in Brazil and abroad, both in physical shops and online, broadening the possibilities of use for customers travelling or shopping on foreign websites.

Mastercard BenefitsThe Mastercard brand brings with it additional benefits, such as the Mastercard Surpreenda programme, where you can collect points and exchange them for products and services. In addition, Mastercard offers travel assistance and emergency services

Complete AppAgibank's application offers complete financial control, allowing customers to check their available limit, monitor their bill in real time, adjust their limit and even temporarily block their card. It's a useful tool for keeping track of spending in a practical way

Discounts at partner establishments: The Agibank Card also offers discounts at a network of partners, enabling customers to save on various purchases and services

Invoice instalments: Agibank allows you to pay your bill in up to 12 instalments, which can be an advantage for those who may need more flexibility when paying

Disadvantages

Annuity charges after the first yearThe annual fee is waived for the first year only. From the second year onwards, there is a charge that can vary according to the customer's profile and the use of the card, something that may not suit all users

No Cashback Programme: Although the Agibank Card offers discounts with partners, it does not have a cashback programme, which can be a negative point for those looking for this type of benefit with their credit cards

Variable LimitThe card's initial limit is set based on the customer's credit analysis, which may result in a low initial amount for some customers, depending on their financial history.

No Premium Assistance: Compared to more robust credit cards, the Agibank Card does not offer benefits such as travel insurance or VIP lounges at airports, features that may be lacking for frequent travellers

How to apply for an Agibank Card

Applying for the Agibank Card is a simple and completely digital process. Follow the steps below to apply:

- Access Agibank's official website or download the Agibank app on your mobile device

- Register by filling in the information required for credit analysis

- Send the requested documents, such as ID or driver's licence, proof of residence and proof of income

- Once the registration has been analysed and approved, you will receive the card at home, ready for use

The analysis time may vary and Agibank reserves the right to approve or disapprove the request based on internal criteria.

*You will be redirected to another site.

Exclusive benefits of the Agibank Card

Service accessible through multiple channels: Agibank customers can count on service through the app, by phone or in face-to-face branches

Complete financial control via the appAgibank's application makes it possible to manage the card, make transfers, pay bills and access investments and additional services.

Discount network: customers can take advantage of offers and benefits in partner shops and establishments, increasing their savings opportunities

Final considerations

The Agibank Card is a great option for those looking for a versatile credit card, with good annual fee-free conditions for the first year and the practical features offered by a digital bank.

With the possibility of managing all finances via the app and Mastercard's international coverage, the card is attractive to a wide range of consumer profiles.

If you want a card with traditional benefits and simplicity of use, the Agibank Card may suit your needs. However, if you're looking for premium benefits or a robust cashback programme, you might want to compare other options on the market.

Neon Card: how to apply

Find out how to apply for this card and take advantage of all its features and benefits!

Continue reading →Frequently Asked Questions

Does the Agibank Card have an annual fee?

Yes, there is no annual fee for the first year. After this period, there may be a charge, depending on the client's profile.

How do I apply for an Agibank Card?

You can apply for the card via the Agibank website or app, by registering and passing a credit analysis.

Does the Agibank Card have a points programme?

Yes, it participates in the Mastercard Surpreenda programme, which allows you to accumulate points with every purchase you make.

What is the Agibank Card limit?

The limit is set based on the credit analysis carried out by Agibank and can vary according to the customer's financial profile.

Can I use my Agibank Card abroad?

Yes, it has international cover and can be used for purchases outside Brazil.

Is it possible to pay the Agibank Card bill in instalments?

Yes, Agibank allows you to pay your bill in up to 12 instalments.

Does the Agibank Card offer cashback?

No, the card doesn't have direct cashback, but it does have discounts with selected partners.