Discover how the Amazon card can transform your online shopping experience with exclusive benefits and attractive cashback.

Adverts

Amid the growth of digital commerce, co-branded credit cards, i.e. those developed in partnership with large retailers, have been gaining momentum in Brazil.

These cards offer specific advantages that benefit consumers when shopping, especially in online shops. One example that stands out is the Amazon cardAmazon Prime, created to offer the platform's customers exclusive benefits, especially for Amazon Prime members.

With Amazon's popularity growing, many consumers are looking for ways to maximise their purchases.

The Amazon card offers just that: cashback on Amazon purchases and other advantageous conditions for those looking for a smart way to shop at the world's largest e-commerce site.

But is this card worth it for everyone? And how can you get one?

Below, we present the most important information about the Amazon card to help you decide whether this is the ideal choice for your consumption profile.

Quick Index:

What is the Amazon Card?

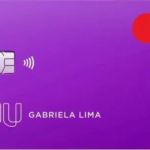

O Amazon card is a credit card developed in partnership with Banco Bradesco and Amazon, aimed primarily at frequent consumers of the platform.

It carries the Visa flag, which guarantees acceptance in millions of establishments in Brazil and around the world. Its main advantages include no annual fee for Amazon Prime members and cashback on purchases made on the platform.

By purchasing this card, Prime customers are entitled to up to 5% of cashback on purchases made on Amazon. For other customers, the cashback is up to 3%, which is still a good advantage for frequent shoppers.

The card thus becomes an attractive option for those who want to save money and, at the same time, enjoy the facilities of a card with no annual fee.

How does the Amazon Card work?

How the Amazon card is simple and practical.

With it, you can make purchases anywhere that accepts Visa and, by using it on Amazon, guarantee cashback which is automatically credited to your next invoices.

To apply for the card, simply go to the Amazon or Banco Bradesco website, fill in the application form and wait for the credit analysis.

Like other credit cards, the limit is granted on the basis of a credit analysis. With the Bradesco app, customers can manage all aspects of the card, including paying the bill, checking the limit and the accumulated cashback balance.

General card features

| Features | Description |

|---|---|

| Card Name | Amazon Prime Card |

| Flag | Visa |

| Issuing Bank | Bradesco Bank |

| Annuity | Free for Amazon Prime members |

| Cover | International |

| Existing models | Gold Visa |

| Limit | Defined according to credit analysis |

| Points Programme | None |

| Cashback programme | Up to 5% cashback for Prime members on Amazon purchases |

| Payment instalments | Exclusive instalments of up to 15 times without interest for Amazon purchases |

| Name of the Management App | Bradesco Cards |

Advantages

Annual fee waiverFor Amazon Prime customers, the Amazon card is completely free of annual fees, which represents significant savings throughout the year.

Cashback on PurchasesThe card offers up to 5% of cashback on purchases made on Amazon for Prime customers, while ordinary customers receive up to 3%.

Exclusive instalmentsPurchases made on Amazon can be paid in up to 15 instalments without interest, giving you greater flexibility in payment.

International Coverage: As a Visa card, it is accepted in millions of establishments worldwide, ideal for those who like to travel or make international purchases.

Control via the Bradesco AppThe app allows the user to manage the card easily, checking the limit, invoice and cashback balance.

Disadvantages

Cashback exclusivityCashback is only valid for purchases made on Amazon, which may limit the benefits for those who wish to use it in other shops.

Annuity for Non-PrimeOnly Prime customers are exempt from the annual fee. Non-Prime customers will pay an annual fee, which may be a negative point for some users.

No Points ProgrammeUnlike other cards, the Amazon card doesn't have a points programme, which can be a disadvantage for those looking to earn miles.

How to apply for an Amazon Card

The process of applying for an Amazon card is simple and can be done online, which makes everything quicker and more accessible. To apply, follow the steps below:

- Visit the Amazon or Banco Bradesco websites: These are the official channels for applying for the card.

- Fill in the membership form: Enter all the information requested and make sure it is correct.

- Wait for the credit analysisBanco Bradesco will carry out an analysis based on your financial history to determine approval.

- Receive the card at homeIf approved, the card will be sent to the registered address.

*You will be redirected to another site.

Final considerations

O Amazon card is an excellent option for those who are regular customers of the platform and want to take advantage of exclusive benefits, especially subscribers to the Amazon Prime programme.

With cashback of up to 5%, no annual fee for Prime, and exclusive instalments of up to 15 times without interest, it is an economical and practical alternative for those who shop frequently on Amazon.

On the other hand, for those looking for a card with a points programme or benefits that go beyond shopping on Amazon, it may be interesting to consider other options.

But overall, the Amazon card stands out for its proposal aimed at Amazon's loyal audience, offering a series of facilities and savings.

Voa Brasil: discounted airline tickets

Want to know how to buy discounted airline tickets? Get to know the Voa Brasil programme and find out how to apply!

Continue reading →Frequently Asked Questions

Does the Amazon card have an annual fee?

For Amazon Prime subscribers, the Amazon card has no annual fee. For others, an annual fee may apply.

What cashback does the card offer?

Prime members receive up to 5% cashback on Amazon purchases, while other customers receive up to 3%.

Where can I use the Amazon card?

The Amazon card is accepted at any establishment that accepts Visa, both in Brazil and abroad.

How can I manage my card?

The card can be managed via the Bradesco Cartões app, where you can track your bill, limit and cashback.

What is the initial limit of the Amazon card?

The limit is set after a credit analysis carried out by Banco Bradesco and can vary according to the client's profile.

Does the Amazon card participate in a points programme?

No, the Amazon card doesn't have a points programme, but it does offer cashback on Amazon purchases.

How do I apply for an Amazon card?

You can apply online by going to the Amazon or Banco Bradesco website and filling in the form.