Discover the advantages of the Inter card and how it can simplify your finances with no annual fee and several exclusive benefits.

Adverts

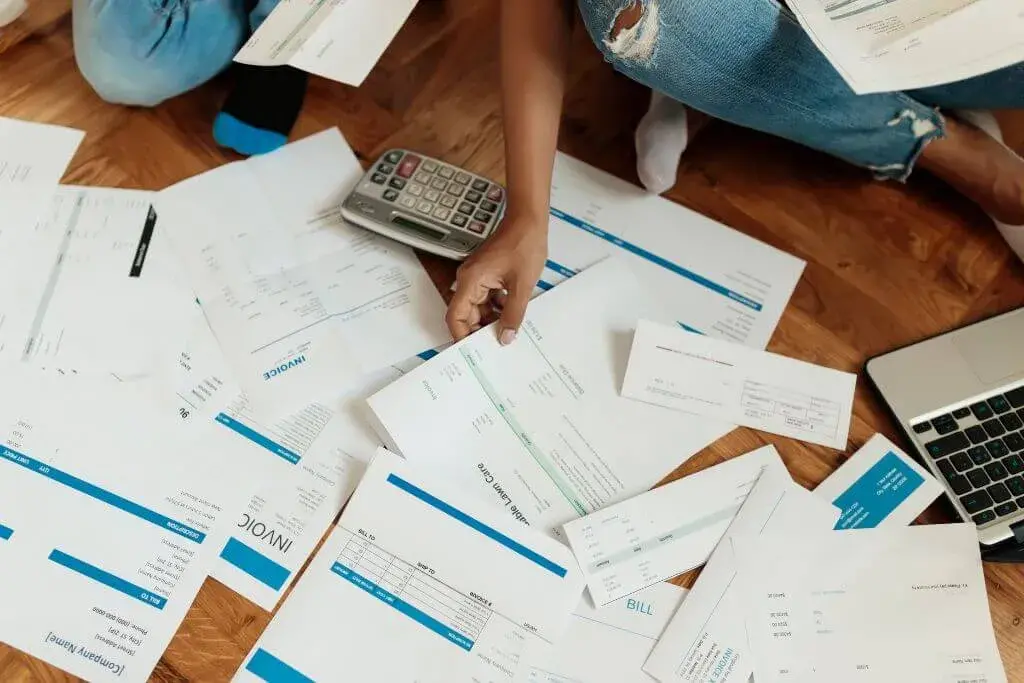

With the advance of fintechs, the Brazilian financial market has started to offer credit card options with less bureaucracy, more benefits and zero annual fees.

Among these options, Banco Inter's Inter Card stands out for being an economical and digital alternative for consumers who value practicality, savings and personalised benefits.

Banco Inter, a pioneer in the digital account segment in Brazil, offers a 100% credit card that is free of annual fees, accessible and with progressive functionalities that adapt to different user profiles, from those who are just looking for a card for everyday use to those who want advantages when travelling and investing.

The Inter Card is available in four modalities, each with specific advantages: Goldideal for routine use; Platinum, aimed at frequent travellers; Black, which offers benefits such as access to VIP lounges at airports; and Winexclusive for high-investment clients.

All versions carry the Mastercard flag and are managed by Banco Inter's Super App, which allows total control of spending, limit adjustments, creation of virtual cards and redemption of points from the Inter Loop programme.

In the course of this article, you'll learn more about the Inter Card, its modalities, advantages and how to apply to take advantage of everything it has to offer.

Quick Index:

What is the Inter Card?

The Inter Card is an international credit card issued by Banco Inter under the Mastercard banner and is widely accepted in Brazil and abroad.

It stands out for its total exemption from annual membership feesBanco Inter's Super App allows users to keep track of their spending, pay bills, adjust limits and even redeem points accumulated in the rewards programme.

Every purchase made with the Inter Card accumulates points in the Inter LoopThe bank's exclusive loyalty programme, which allows points to be exchanged for cashback, miles and discounts on bills.

Scores vary according to the type of card, with Platinum, Black and Win cards offering higher accumulations and differentiated benefits, such as purchase protection, travel insurance and access to VIP lounges at airports.

The Inter Card is not only an economical alternative, but also a practical and safe tool for those who value complete financial control in the palm of their hand.

In addition, it offers the possibility of increasing the limit based on investments in Banco Inter itself, with the CDB Plus Credit Limitwhere the amount invested in the CDB is transformed into a limit on the card.

In this way, the Inter Card caters for consumers who are looking for a basic, free option, as well as customers who want exclusivity and advantages in their daily transactions.

Inter Card Modalities

Inter Gold CardRecommended for users who make regular purchases, Gold offers basic Mastercard benefits such as Price Protection Insurance e Protected Purchaseplus 1 point for every R$ 10 spent on the Inter Loop.

Inter Platinum CardInter Platinum: Ideal for frequent travellers, Inter Platinum offers benefits such as the Priceless Citiestravel assistance and 1 Inter Loop point for every R$ 5 spent. To obtain this version, the customer must be a member of the Inter One programme or have spent at least R$ 5,000 on invoices in recent months.

Inter Black Card: The Black version includes exclusive advantages, such as free access to VIP lounges at airports by Mastercard Airport Experience. It also offers 1 Inter Loop point for every R$ 2.50 spent. Customers can get Inter Black by spending R$ 7,000 on their bills over the last few months.

Inter Win CardAimed at clients with an investment portfolio of R$ 1 million or more at Inter, Win offers benefits such as access to VIP lounges, travel insurance and purchase protection, and accumulates 1 Inter Loop point for every R$ 2 spent.

General Features

| Features | Description |

|---|---|

| Card Name | Inter Card (Gold, Platinum, Black and Win) |

| Flag | Mastercard |

| Issuing Bank | Inter Bank |

| Annuity | Exempt |

| Cover | National and international |

| Modalities | Gold, Platinum, Black and Win |

| Points Programme | Inter Loop |

| Cashback | Available for redemption in the Inter Loop programme |

| Payment instalments | Up to 8 instalment options via the Super App |

| Official Website | Inter Card |

| Management App | Banco Inter Super App, available for iOS and Android |

Advantages

Annual fee waiverThe Inter card does not charge an annual fee in any of its modalities.

Inter Loop Points ProgrammeThe customer accumulates points according to the type of card, which can be converted into cashback, miles, discounts on the bill, etc.

International Card and No Fees: The Inter Card is accepted internationally, with no administration fees or annual fees.

Mastercard benefitsAccess to exclusive programmes such as Priceless Cities, travel insurance, purchase protection and much more.

Complete control via the Super AppIn the Banco Inter app, the user can adjust the limit, monitor invoices, request virtual cards and access all the card's functionalities.

Access to VIP loungesAvailable in Black and Win versions, allowing access to VIP lounges at airports via the Mastercard Airport Experience.

Disadvantages

Requirements for Higher ModalitiesAccess to the Platinum, Black and Win versions is subject to specific criteria, such as volume of spending or investment balance.

Frequent User Points ProgrammeInter Loop may not be so advantageous for users who don't regularly use their card to accumulate points.

How to apply for the Inter Card

To apply for the Inter Card, the process is simple and can be done directly through the bank's Super App:

- Download the Banco Inter Super AppThe app is available for iOS and Android.

- Open your Digital AccountTo access the card, you need to open a free digital account with Banco Inter.

- Request the Credit Function: Access the app and request the credit function, subject to credit analysis.

- Choose a modalityDepending on your customer profile, you can request specific modalities or be upgraded to higher versions depending on your usage and relationship with the bank.

*You will be redirected to another site.

Exclusive benefits

- Points in the Inter Loop: Points programme offering cashback, miles, bill discounts and more.

- Virtual Cards: Create virtual cards for online purchases, ensuring greater security.

- CDB Plus LimitInvesting in the CDB Mais Limite, the amount invested becomes a credit card limit.

- Nearby Payments and Digital WalletsCompatible with Apple Pay, Google Pay and Samsung Pay, enabling fast, contactless payments.

- Access to VIP Lounges and ConciergeAvailable in Black and Win, with access to VIP lounges and concierge support.

Final considerations

The Inter Card is an excellent option for those looking for a complete card, with no annual fee and progressive benefits, depending on the modality.

Whether it's for those who want practicality in their day-to-day shopping or those looking for exclusive advantages when travelling and making international purchases, Inter caters for different profiles with different advantages.

If you want an international card with no fees and complete control via your mobile phone, the Inter Card is a robust and economical option. Evaluate the types of card on offer and choose the one that best suits your profile and financial needs.

Player's Bank Card: how to apply for one

Find out how to apply for this card and take advantage of all its features and benefits!

Continue reading →Frequently Asked Questions

Does the Inter Card have an annual fee?

No, all Inter Card types are free of annual fees.

How does the Inter Loop points programme work?

Inter Loop allows you to accumulate points with every purchase, which can be exchanged for cashback, miles and discounts on your bill.

Can I access VIP lounges with my Inter Card?

Yes, Inter Black and Win cards offer access to VIP lounges at airports.

What are the criteria for obtaining the Inter Platinum, Black or Win Card?

The Platinum Card requires minimum spending or participation in the Inter One programme, while the Black and Win cards require higher volumes of spending or investments.

Is the Inter Card accepted internationally?

Yes, it has international cover and is accepted outside Brazil.

Does Inter offer virtual cards?

Yes, virtual cards are available for online purchases, providing more security for digital transactions.